portland oregon sales tax rate 2020

In 2002 the inflation index changed from the Portland CPI to the US. This is the total of state county and city sales tax rates.

Want To Pay Lower Cell Phone Taxes Move To Oregon Geekwire

This is the total of state county and city sales.

. Taxes in Oregon. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. Redmond OR Sales Tax Rate.

City of Portland Business License Tax rate. West Linn OR Sales Tax Rate. California 1 Utah 125 and Virginia 1.

Aumsville Real Estate Market Conditions. If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not meet the 90 threshold under the new BIT rate 200 quarterly interest will be waived. The state sales tax rate in Oregon is 0 but you can.

This is the total of state county and city sales tax rates. The companys gross sales exceed 100000 or. Business Tax Rates and Other FeesSurcharges Business Tax Rates.

In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. Oregon State Tax Quick Facts. There is no applicable state tax.

The lower three Oregon tax rates decreased from last year. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000.

For more information and a flowchart to determine if vehicle use tax is due. 653 change since last quarter. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

3600 cents per gallon of regular gasoline and diesel. Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or local level. Portland Property Tax Rates.

Oregons property tax rates are higher than a number of other States. Other FeesSurcharges Residential Rental Registration RRR Fee. Please complete a new registration form and reference your existing account 3.

View City Sales Tax Rates. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers. The current total local sales tax rate in Portland OR is 0000.

The Salem sales tax rate is. Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Sales Tax Breakdown Portland Details Portland OR is in Multnomah County.

Roseburg OR Sales Tax Rate. Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion. The main reason is that we do not have a sales tax on anything.

Median sales price 436000. Instead of the rates shown for the Portland Tourism Improvement District Sp tax region above the following tax rates apply to these specific areas. Wayfair Inc affect Oregon.

The County sales tax rate is. Multnomah County Business Income Tax rate. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

The tax established by the Business License Law is 22 percent of adjusted net income for tax years beginning on or before December 31 2017. The Oregon sales tax rate is currently. 503-678-2020 All information provided is deemed.

The minimum combined 2022 sales tax rate for Portland Oregon is. On May 19 2020 voters in the greater Portland Oregon metro area 1 approved Measure 26-210 imposing a new 1 tax on certain individuals and a 1 business profits tax on certain businesses. Oregon Income Tax Rate 2020 - 2021.

Though there is no state sales tax Oregon was noted in Kiplingers 2011 10 Tax-Unfriendly States for Retirees due to having one of the highest tax rates on personal income in the nation. Oregon cities andor municipalities dont have a city sales tax. The Oregon sales tax rate is currently.

Lake Oswego OR 97035. Salem OR Sales Tax Rate. The Portland sales tax rate is.

The minimum combined 2022 sales tax rate for Aumsville Oregon is. LoginAsk is here to help you access Portland Oregon Sales Tax 2020 quickly and handle each specific case you encounter. Five other citiesFremont Los Angeles and Oakland California.

Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. Metro Supporting Housing Services SHS Business Income Tax rate.

2022 Oregon state sales tax. The December 2020 total local sales tax rate was also 0000. Springfield OR Sales Tax Rate.

Portland Oregon Sales Tax 2020 will sometimes glitch and take you a long time to try different solutions. Exact tax amount may vary for different items. To this end we show advertising from partners and use Google Analytics on our website.

OREGON PERSONAL INCOME BRACKETS AND TAX RATES 1930 TO 2020. Oregon cities andor municipalities dont have a city sales tax. View County Sales Tax Rates.

And Seattle Washingtonare tied for the second highest rate of 1025 percent. Tigard OR Sales Tax Rate. What is the sales tax rate in Aumsville Oregon.

The County sales tax rate is. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and. Birmingham Alabama at 10 percent rounds out the list of.

The company conducted more than 200 transactions to South Dakota. Portland is in the following zip codes. Required every tax year.

Oregon City OR Sales Tax Rate. 97201 97202 97203. The Portland sales tax rate is.

The Oregon OR sales tax rate is currently 0. Last updated August 2022. Oregons sales tax rates for commonly exempted categories are listed below.

Oregon counties and cities have the right to impose a sales tax at the local level. Filing Requirements All businesses that report total gross income of 1 billion or more and Portland gross income of 500000 or more on their Combined Business Tax. The 2018 United States Supreme Court decision in South Dakota v.

Revenue generated by the new taxes will help fund homeless services. Just think you can buy a new car and only pay an additional 50 for a two-year auto registration. 2022 Oregon Sales Tax Table.

Did South Dakota v. Tualatin OR Sales Tax Rate. Portland OR Sales Tax Rate.

The City of Portland Oregon. The first thing to know about the state of Oregons tax system is that it includes no sales tax. Since 1993 the tax brackets have been indexed for inflation.

Taxpayers may submit a waiver request along with their 2020 combined tax return. 090 average effective rate. Beginning with tax year 2021 the new taxes are imposed on businesses and individuals in Washington Clackamas and.

For example under the South Dakota law a company must collect sales tax for online retail sales if.

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

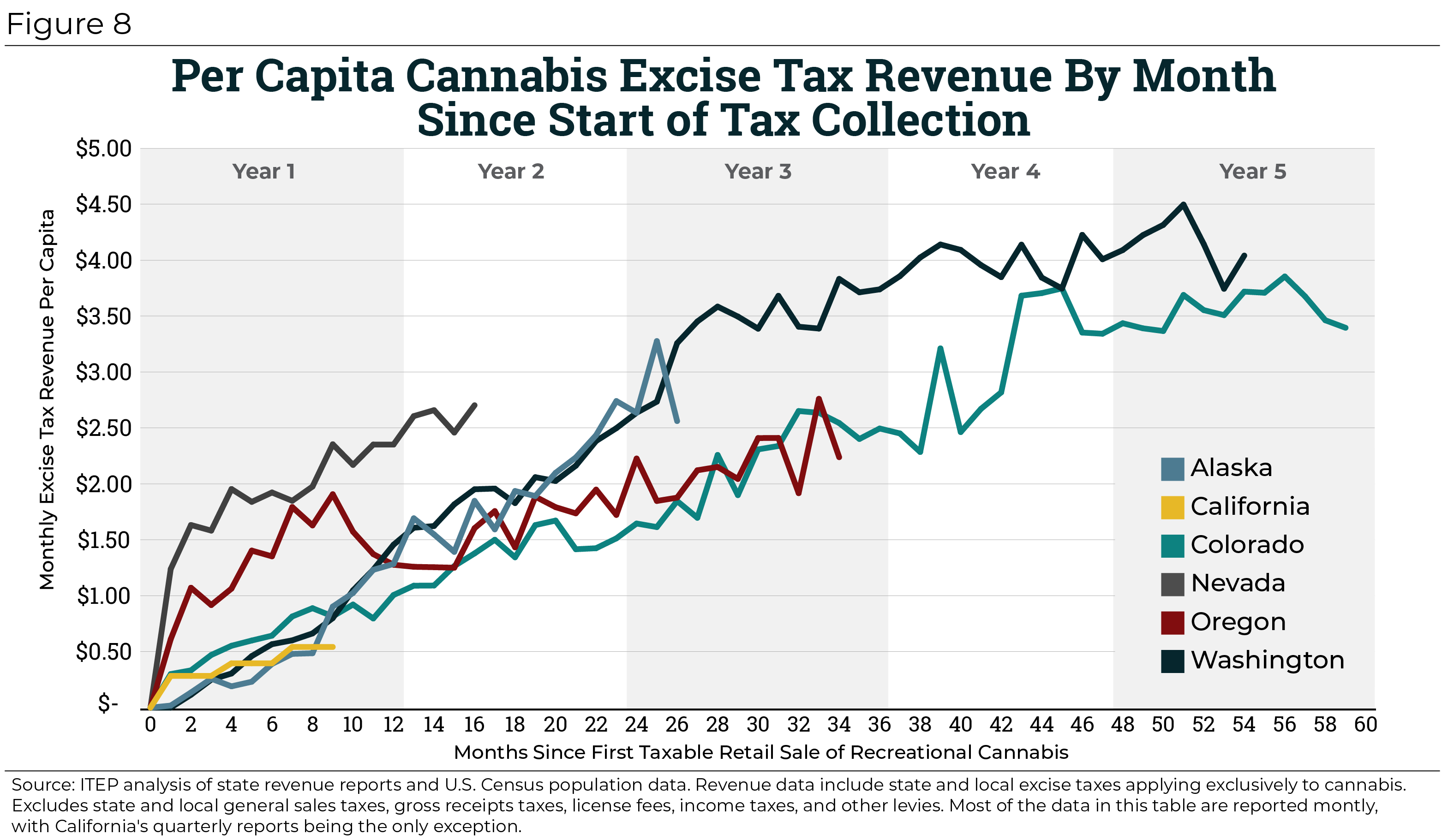

Marijuana Outlook March 2022 Oregon Office Of Economic Analysis

State Of Oregon Blue Book Government Finance Taxes

Oregon Retirement Tax Friendliness Smartasset

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Oregon Estate Tax Everything You Need To Know Smartasset

Which States Have No Sales Tax Quora

Historical Oregon Tax Policy Information Ballotpedia

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

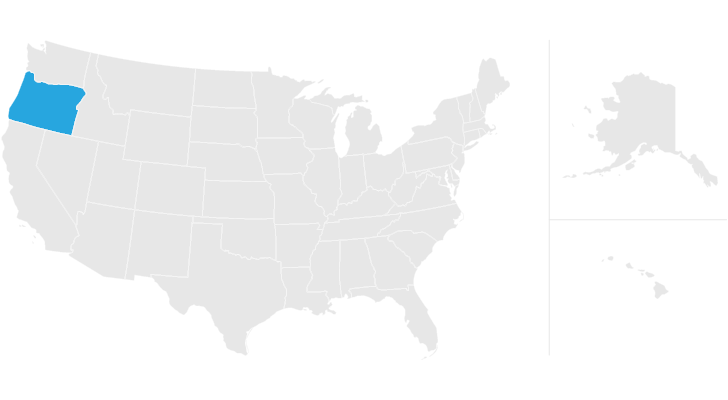

Oregon Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Sales Tax By State Is Saas Taxable Taxjar

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Study Washington Oregon Have Highest Taxes On Liquor In The U S Local Bigcountrynewsconnection Com